After a historically strong start to the year, markets have now pulled back 2.5% to begin the second quarter. Concerns around geopolitical tensions in the Middle East, inflation, corporate earnings, and other issues have led to a market decline, pushing the VIX index of stock market volatility to its highest level in six months. In times of market stress, it’s important for investors to maintain perspective on the critical issues and not overreact to headlines. How can investors understand and weather this period of market volatility?

Rising Geopolitical Tensions Add to Market Uncertainty

First, tensions escalated in the Middle East recently due to an attack by Iran on Israel, the first time a direct strike has occurred between the two nations. The attack involved hundreds of drones and missiles launched from Iran and appears to have been designed to allow ample time for Israel and its allies to deploy countermeasures, resulting in minimal damage. In retaliation, Israel conducted modest targeted strikes against Iran, raising concerns about further escalation. Iran has downplayed the impact of the attack and has expressed no interest in responding against Israel. While the situation remains fluid, many hope that both nations will show restraint and avoid further conflict.

These latest developments only add to geopolitical concerns around the world. Russia’s invasion of Ukraine and the October 7 attack on Israel by Hamas only a year and a half later have already destabilized Eastern Europe and the Middle East. Without diminishing the tragic loss of life and destruction from these conflicts, investors must weigh how such events might impact the global economy, markets, and their portfolios.

Geopolitical headlines can be alarming to investors since they are unlike the typical flow of business and market news. These events are difficult to analyze and their outcomes are challenging to predict since they depend on the actions of individuals and groups with complex histories and motivations.

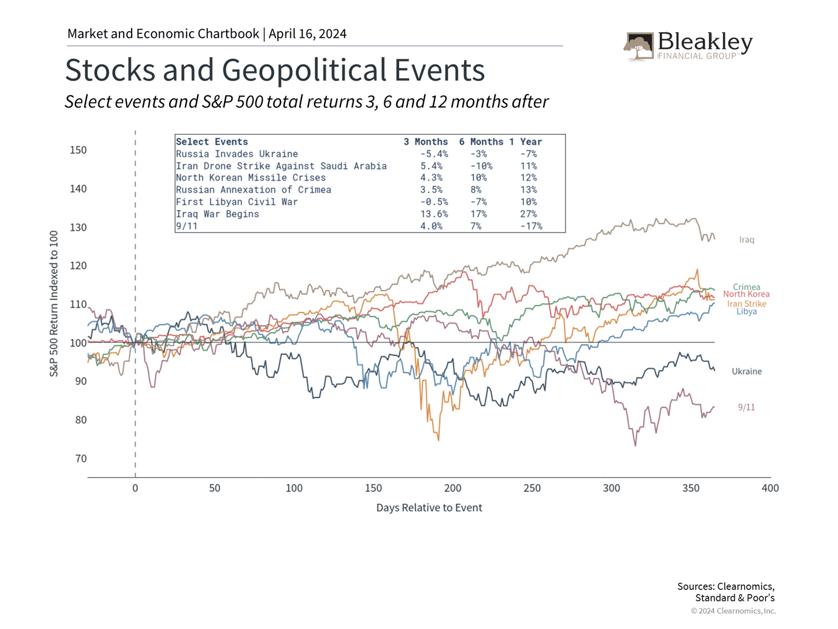

However, history shows that while geopolitics can impact markets, the effects are typically short-lived. The accompanying chart highlights market returns following major geopolitical events this century. Some events, such as 9/11, changed the world order and had long-lasting effects, even though it was primarily the dot-com bust that led to poor market performance. Other events, such as the war in Ukraine, resulted in higher oil prices which affected inflation and monetary policy. Most of these events did not have long-lasting effects on markets once the situation stabilized.

While today’s conflicts will be closely watched, investors ought to avoid passing judgment with their portfolios. In the long run, markets tend to recover and perform well primarily because business cycles are what matter over years and decades, despite the events that take place over weeks and months.

Stubborn Inflation Has Markets Rethinking the Number of Rate Cuts

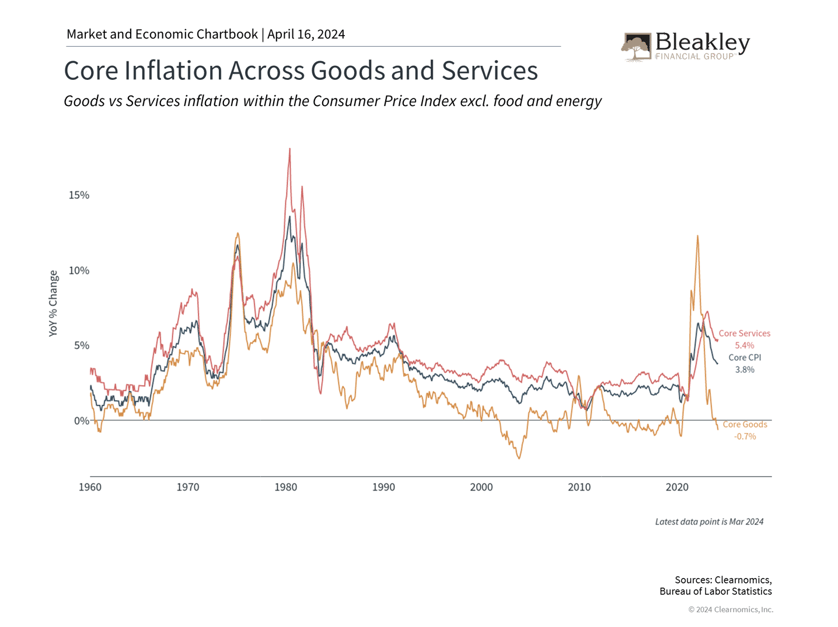

Second, many measures of inflation have proven to be more stubborn than economists had hoped. The latest Consumer Price Index (CPI) report for March showed that headline inflation remained hotter than anticipated at 3.5% year-over-year, while core inflation, which excludes food and energy prices, rose 3.8%. Rising shelter costs, i.e., the cost of renting and owning a home, are a large reason inflation has not cooled as quickly.

Combined with stronger-than-expected recent job market data, many investors now anticipate that the Fed may cut rates more slowly this year – or not at all. The Fed’s economic projections have suggested all along that it might cut rates three times this year. Market expectations, however, have swung 180 degrees since the start of the year when some believed the Fed could begin cutting rates in March or earlier. Today, markets only expect 2 or 3 rate cuts in 2024.

As always, it’s important for investors to keep these expectations in perspective. What matters for long-term investing is the direction of policy and not the exact timing or magnitude of rate cuts. There are still risks to the Fed’s outlook and the monthly inflation numbers, especially if oil prices rise further due to geopolitical conflicts. However, even if this were to occur, inflation is far more manageable today and no longer requires an emergency monetary response.

Investors Should Always Be Prepared for Market Volatility

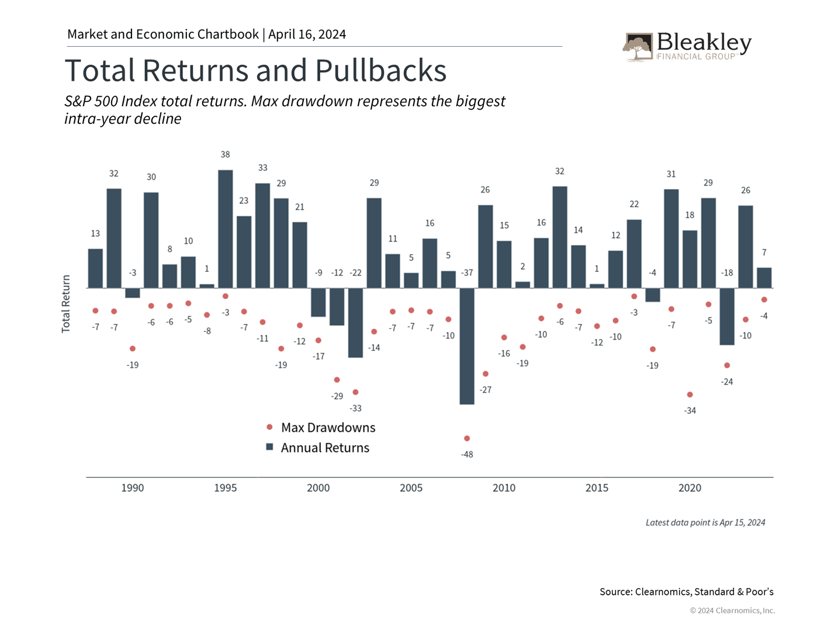

Finally, investors should keep the level of market volatility in perspective as well. While the recent 2.5% market decline is the largest since the start of the year, this follows a 10.6% total return in the first quarter. Since last October when the market began to rally, the S&P 500 has gained 28% including dividends. Since the bear market bottom in 2022, the market has gained over 50%.

The accompanying chart shows that the average year experiences significant pullbacks and that this year’s has been small by comparison. Despite these short-term challenges, markets tend to recover and often end on positive notes. This is why maintaining a diversified portfolio can help minimize short-term risk and increase the odds of financial success over time, regardless of whether markets are volatile due to the economy, the Fed, geopolitics, or other factors.

The bottom line? Markets have struggled at the start of the second quarter due to changing expectations around the Fed and escalating geopolitical tensions. Staying level-headed and keeping these events in perspective are still the best ways to pursue long-term financial goals.

Disclaimer

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The market and economic data is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The information in this report has been prepared from data believed to be reliable, but no representation is being made as to its accuracy and completeness. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

This commentary is for informational purposes only and is not meant to constitute a recommendation of any particular investment, security, portfolio of securities, transaction or investment strategy. No chart, graph, or other figure provided should be used to determine which securities to buy, sell or hold. No representation is made concerning the appropriateness of any particular investment, security, portfolio of securities, transaction or investment strategy. You should speak with your own financial professional before making any investment decisions.

Past performance is not indicative of future results. Bleakley Financial Group, LLC does not guarantee any specific outcome or profit. These disclosures cannot and do not list every conceivable factor that may affect the results of any investment or investment strategy. Risks will arise, and an investor must be willing and able to accept those risks, including the loss of principal.

Certain statements contained herein are statements of future expectations and other forward looking statements that are based on opinions and assumptions that involve known and unknown risks and uncertainties that would cause actual results, performance or events to differ materially from those expressed or implied in such statements.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.

Advisors associated with Bleakley Financial Group may be: (1) registered representatives with, and securities offered through LPL Financial, Member FINRA/SIPC, (2) registered representatives with, and securities offered through LPL Financial, Member FINRA/SIPC and investment advisor representatives of Bleakley Financial Group; or (3) solely investment advisor representatives of Bleakley Financial Group, and not affiliated with LPL Financial. Investment advice offered through Bleakley Financial Group, a registered investment advisor and separate entity from LPL Financial.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Approval #567334

About the Author

Bleakley Financial Group

For close to 40 years, Bleakley Financial Group has been providing customized financial planning and wealth management services to a diverse array of clients across the country. Our team consists of more than 150 financial professionals, from financial advisors and research assistants to client support associates. Bleakley services over $9.97 billion in client brokerage and advisory assets across four different custodial platforms (as of 1.10.25).